Michael M. Santiago

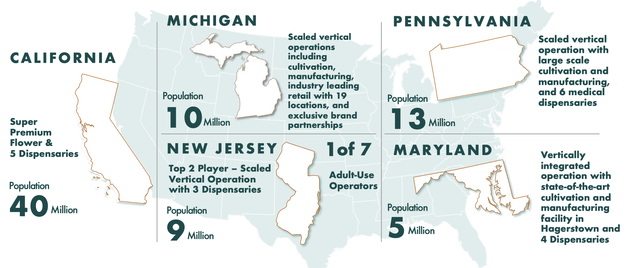

Vertically integrated multi-state operator („MSO“) TerrAscend Corp. (OTCQX:TSNDF) owns three retail brands: The Apothecarium, GAGE Cannabis, and Allegany Medical Marijuana Dispensary. The company had a great 2023, driven by its 38 Dispensaries across Maryland, Pennsylvania, New Jersey, Michigan, California, and Canada. The common stock was up roughly 51% even as its cash and equivalents balance sat at its lowest level since before the pandemic. This figure was $27.3 million at the end of its fiscal 2023 third quarter, down $3.5 million sequentially and by 28% from $37.8 million in the year-ago period.

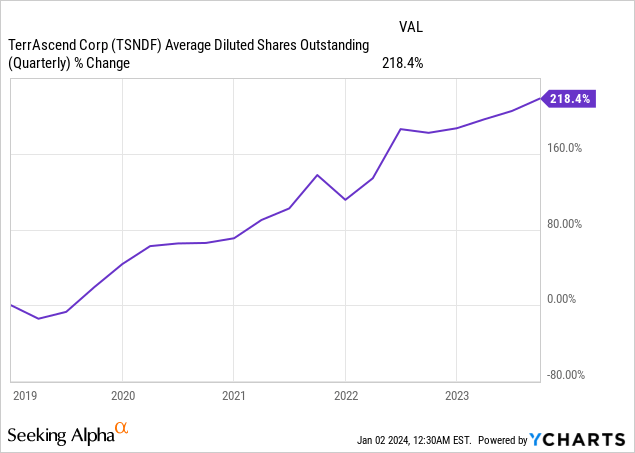

TSNDF was not GAAP profitable and has been fully dependent on a mix of dilution and debt to remain a going concern. Total debt at the end of its third quarter stood at $203.6 million as its diluted weighted average number of common and proportionate voting shares outstanding of 287,072,972 at the end of the third quarter was up 12.86% from its year-ago period and an incredible 218% over the last five years. Dilution since I last covered the ticker has been strong. There is also $58 million of corporate income tax payable within 12 months and another $38.2 million non-current deferred income tax liability.

Revenue Moves Higher, Margins Up, And Positive Free Cash Flow

TerrAscend Fiscal 2023 Third Quarter Form 10-Q

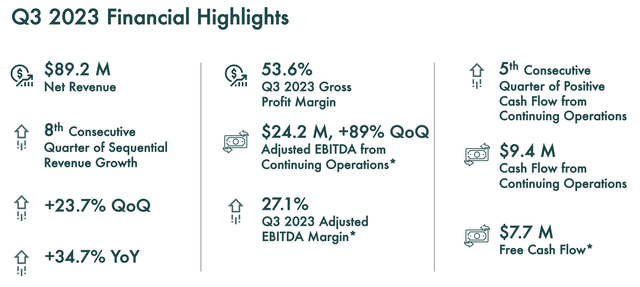

TSNDF did generate a positive free cash flow of $7.7 million during its third quarter. This came despite a GAAP net loss of $10.8 million in the third quarter as non-cash expenses including $6.1 million in depreciation and amortization meant the adjusted operating cash flow was positive at $9.4 million. Third quarter revenue of $89.2 million was up 33.1% over its year-ago comp and also beat consensus estimates by $6.33 million.

TerrAscend Fiscal 2023 Third Quarter Presentation

New Jersey is TSNDF’s largest and most profitable market, with the company a top two player with a market share that, at 18.6% at the end of the third quarter, was just 20 basis points less than the number one spot. TSNDF is chasing a longer-term growth opportunity to open an additional 7 retail locations in New Jersey to cement its leadership. Critically, the third quarter saw a realized gross profit margin of 53.6%, up sequentially from 50.23% and from 47.62% in the year-ago comp. TSNDF also grew adjusted EBITDA from continuing operations by nearly 90% from the second quarter, with adjusted EBITDA margins coming in at 27.1%.

TerrAscend Fiscal 2023 Third Quarter Presentation

The company also paid down $5.7 million of debt and raised its outlook for net revenue and adjusted EBITDA for the full year to $320 million and $73 million, respectively. This is up from prior guidance for revenue to come in at $317 million, with adjusted EBITDA at $63 million. There has now been a steady upward ramp of revenue and gross profit, with TSNDF’s investment pitch built around what’s now set to be a 1.82x price-to-sales multiple against gross and adjusted EBITDA margins that are improving.

TSNDF Will Need To Push Through More Dilution

The strong price returns through 2023 reflect this fundamentally strong position, with positive free cash flow and ramping revenue on the back of new acquisitions. However, TSNDF has so far failed to filter through a broadly strong operating performance to its balance sheet. Positive cash movements were heavily driven by the company’s decision to defer paying taxes. To be clear, there is around $146.4 million in current liabilities, of which 40% is constituted from a $58.7 million upcoming tax payment. Hence, the free cash flow numbers provided by TSNDF should be heavily caveated. Heavy taxes are one of the core reasons that MSOs have not performed well, and the company’s tax liabilities are more than its cash position.

There is a $31.4 million gap when cash is adjusted for current tax liabilities. This figure drops marginally when restricted cash of $600,000 is included. Hence, there will be a need for more dilution to plug the upcoming gap in cash. This comes as the Fed is set to possibly cut interest rates later this year, a move that would undoubtedly reinvigorate animal spirits and act as a salvo to the long-beleaguered cannabis industry. This forms a near-term risk facing bears, as risk-off sentiment has a negative correlation with interest rates and capital will undoubtedly flow back to cannabis tickers in response to such a move by the Fed.

TSNDF at its current level, though, is a firm with healthy margins and revenue that is on the up, albeit with a poor balance sheet and heavy dilution of around 44% per year over the last five years. The pace of TerrAscend Corp. dilution renders a possible position in the commons a total non-starter even as the dilution has been critical to keep the lights on.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.